oklahoma franchise tax mailing address

And you are filing a Form. Online Registration Reporting Systems.

Incorporate In Oklahoma Do Business The Right Way

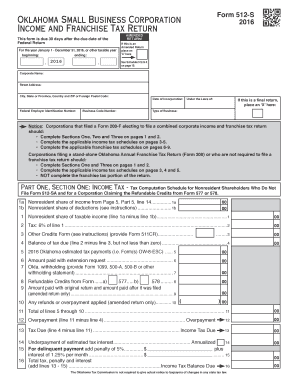

Taxpayer FEIN Write the correct federal employ-.

. Mailing Address Change I. The Oklahoma Tax Commission can be reached at 405 521-3160. Please make corrections in the space provided in Item H J or K.

TaxFormFinder - One Stop Every Tax Form. Oklahoma Annual Franchise Tax Return. Mail this return in the enclosed envelope.

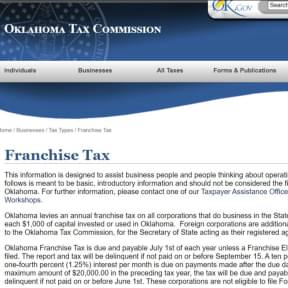

General Oklahoma Tax Commission. In Oklahoma the maximum amount of franchise tax a. Oklahoma Franchise Tax is due.

EditAdd a taxpayer level DBA Name and Mailing Address. Oklahoma Tax Commission Franchise Tax PO. Oklahoma franchise tax is due and payable each year on July 1.

Oklahoma Franchise Tax is due. New Mailing Address City State or Province Country and Postal Code B. Current Officer Information.

It will be used to establish your identity for tax purposes only. Paper returns without a 2-D barcode should be mailed to the Oklahoma Tax Commission PO. If a business is subject to the.

Here are some things you need to know. Please include your return payment balance sheet and schedules A B C and D. Rural Electric Co-Op License.

Oklahoma City OK 73126-0850. Ledger Reports Oklahoma Equal Opportunity Education Scholarship Credit OTC County Apportionment for Distribution of Tax Revenues. When is franchise tax due.

Copyright 2007 Oklahoma Tax Commission Security Statement Privacy Statement Feedback OKgov Last Modified 10222007. Oklahoma Tax Commission Address Phone Numbers. 7 rows If you live in Oklahoma.

Give Us a Call. New Mailing Address City State or Province Country and Postal Code B. You MUST provide this information.

Please include your return pay-ment made payable to Oklahoma Tax Commission balance sheet and schedules A B C and D. Mail this return to the address below. A business must file a form with the state to determine whether it is subject to the franchise tax.

Current Officer Information. General Oklahoma Tax Commission Address. Late payments of franchise tax 100 of the franchise tax liability must be paid with the extension.

For a corporation that has elected to change its filing period to match its fiscal year the franchise. If Incorrect Then 1. Items A or B or the name or address is incorrect.

Mail this return to the address below. And you are not.

Oklahoma Form 512 S Fill Online Printable Fillable Blank Pdffiller

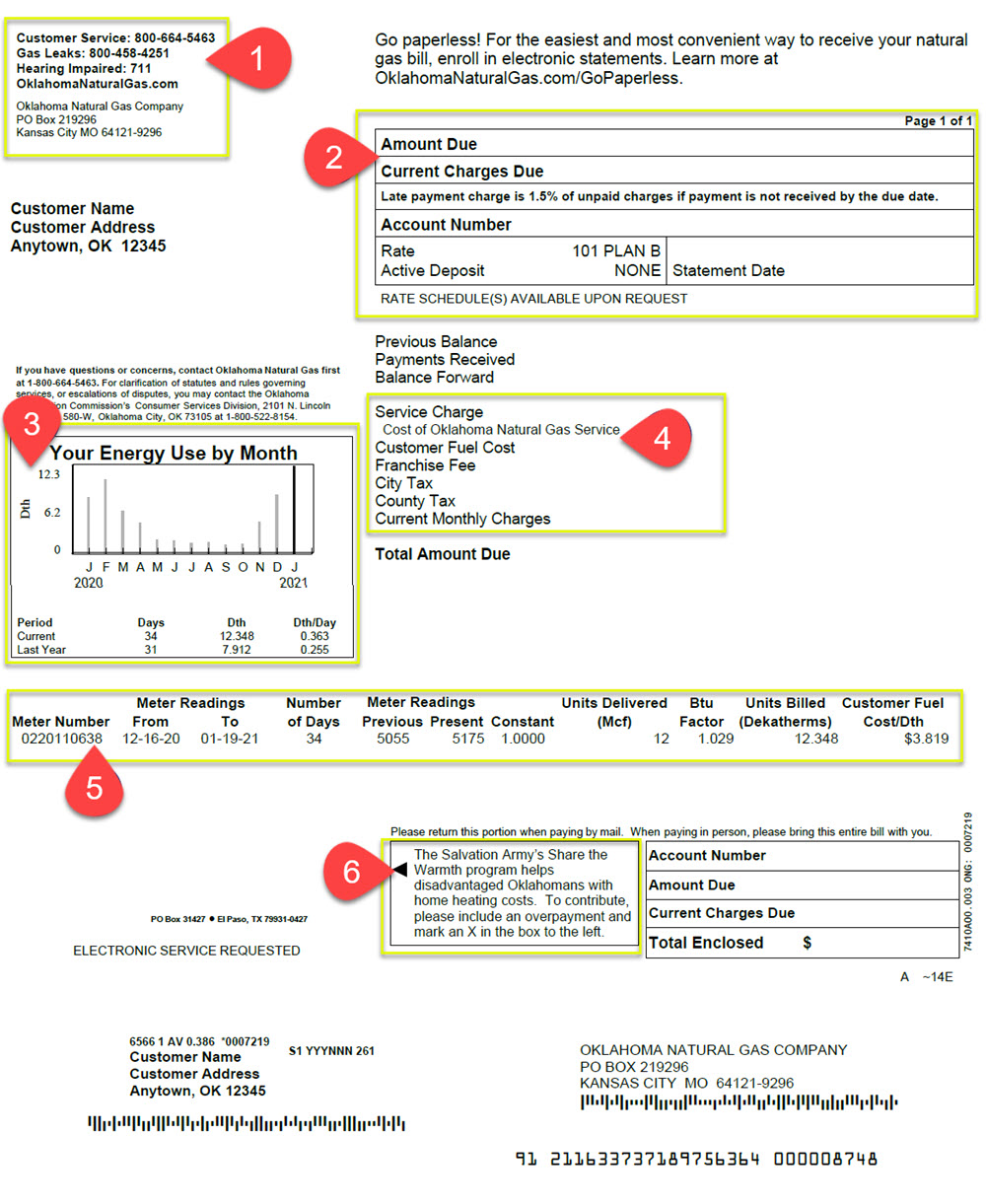

Oklahoma Natural Gas Understand Your Bill

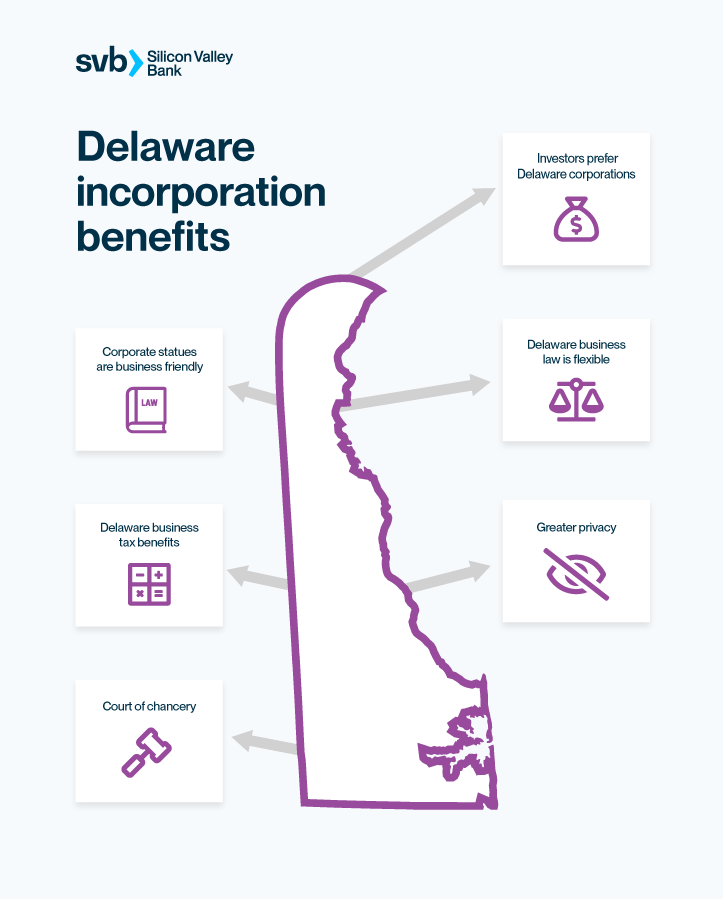

Why Incorporate In Delaware Silicon Valley Bank

Tennessee Franchise Excise Tax Price Cpas

Fill Free Fillable Forms State Of Oklahoma

How To Start A Business In Oklahoma

Free Oklahoma Tax Power Of Attorney Form Bt 129 Pdf Eforms

What Is Franchise Tax Legalzoom

Franchise Tax Definition Meaning In Stock Market With Example

200 Oklahoma Annual Franchise Tax Return Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

Oklahoma Annual Report Filing File Online Today Zenbusiness Inc

Does Your State Levy A Capital Stock Tax Tax Foundation

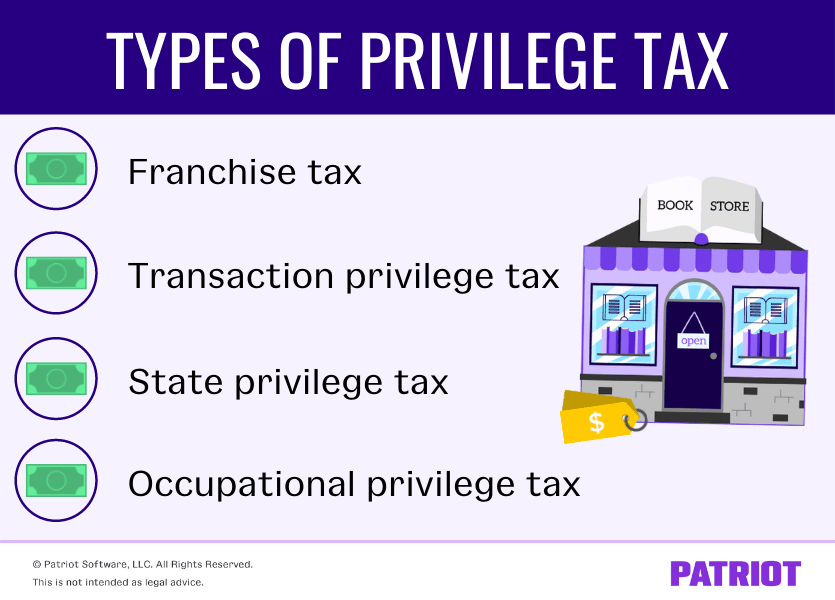

What Is Privilege Tax Types Rates Due Dates More

Fill Free Fillable Forms State Of Oklahoma

How To File And Pay Sales Tax In Oklahoma Taxvalet

Top Rated Tax Resolution Firm Tax Help Polston Tax

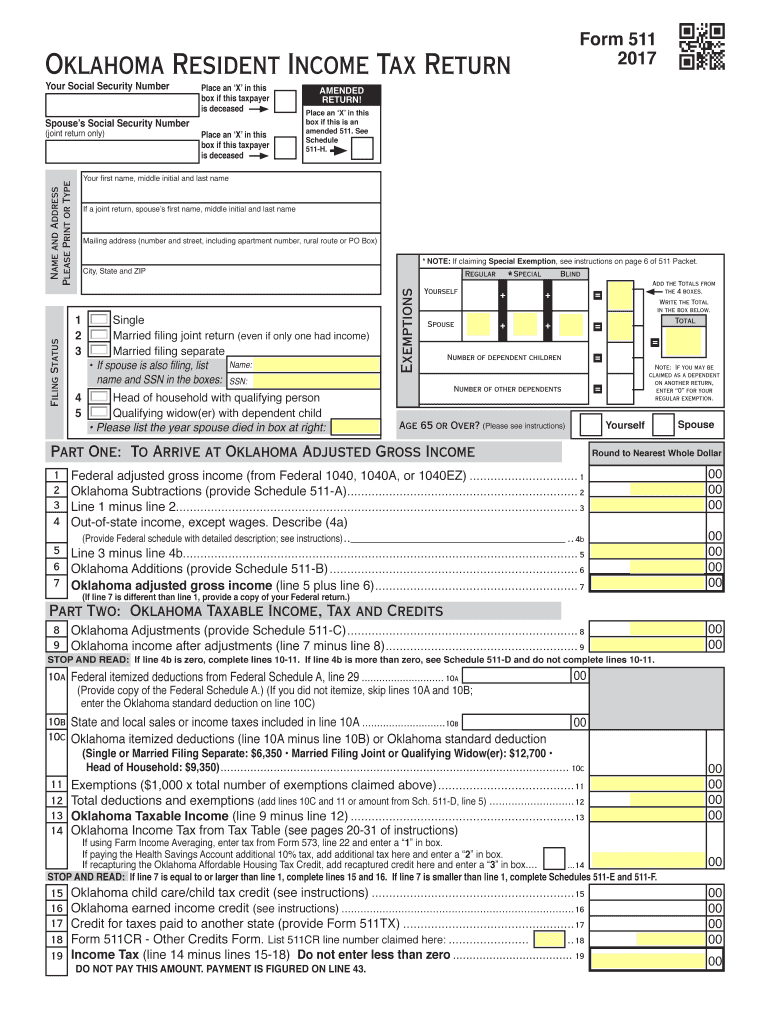

Oklahoma Resident Tax Form 511 2014 Fill Out Sign Online Dochub